Asset Management

Overview

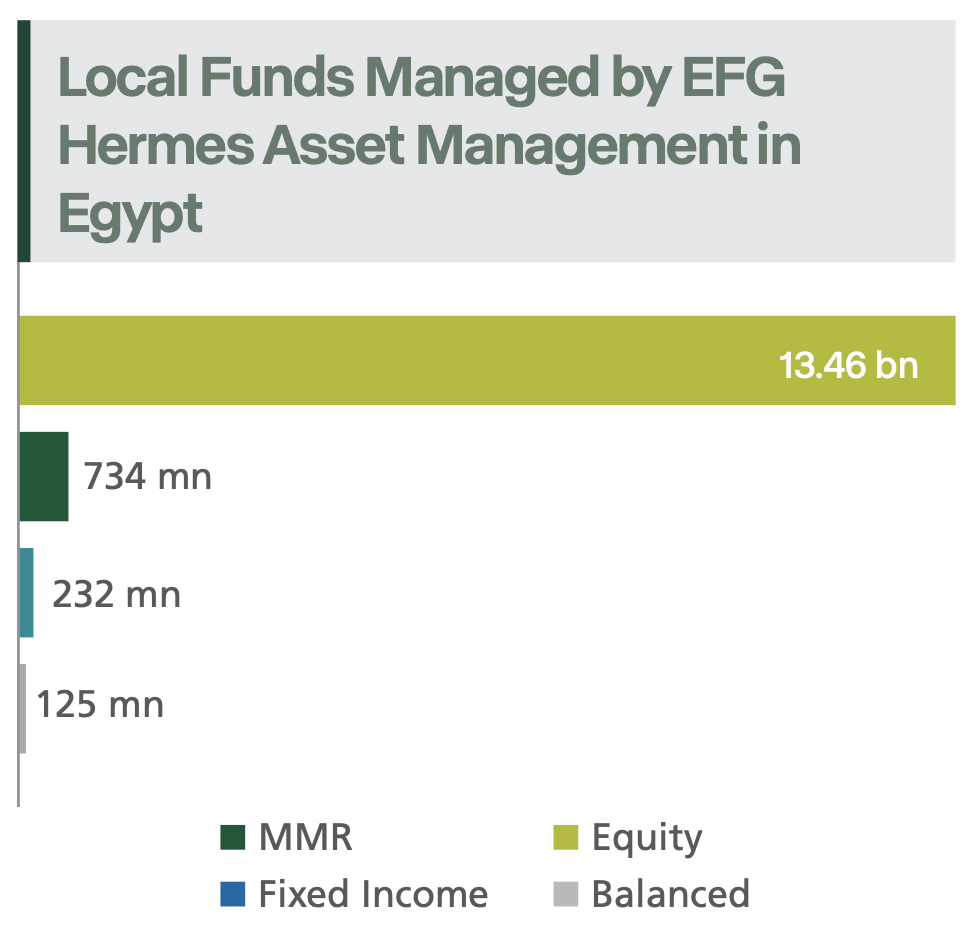

EFG Hermes’ Asset Management division, the MENA region’s flagship asset manager, boasts a remarkable track record dating back to 1994. Throughout its decades of operations, the division has offered its clients a diverse, comprehensive spectrum of mutual funds and discretionary portfolios comprising of both country-specific and regional mandates. The division’s mandates include equity, money market, fixed income, indexed, and Sharia- and UCTIS-compliant mandates. Boasting an expansive client base of individual and institutional investors, as well as large government entities, the division leverages its teams of regional industry experts to provide bespoke financial advisory, lucrative investment prospects, market insights, and other value-added services. EFG Hermes Asset Management offers tailored products and puts capital to work in a manner that best serves individual needs, unique financial objectives, and risk appetites.

Operational Highlights of 2021

2021 was an exceptional year for the Firm’s Asset Management division, with regional markets witnessing a rapid recovery in activity after a year of pandemic-driven market turbulence in 2020. Backed by the relaxation of lockdown restrictions, business re-openings, higher vaccine roll-outs, and rising oil prices, economic activity continued to ramp up throughout 2021. Inflation rates witnessed a significant rise throughout the year, as increasing demand continued to be matched with major supply chain shocks. Despite the present market volatilities, the MENA region’s capital markets fared remarkably well during the year. In 2021, EFG Hermes Asset Management’s fund and portfolio performance continued to outperform peer averages, allowing the division to maintain its leading position as the regional asset manager of choice.

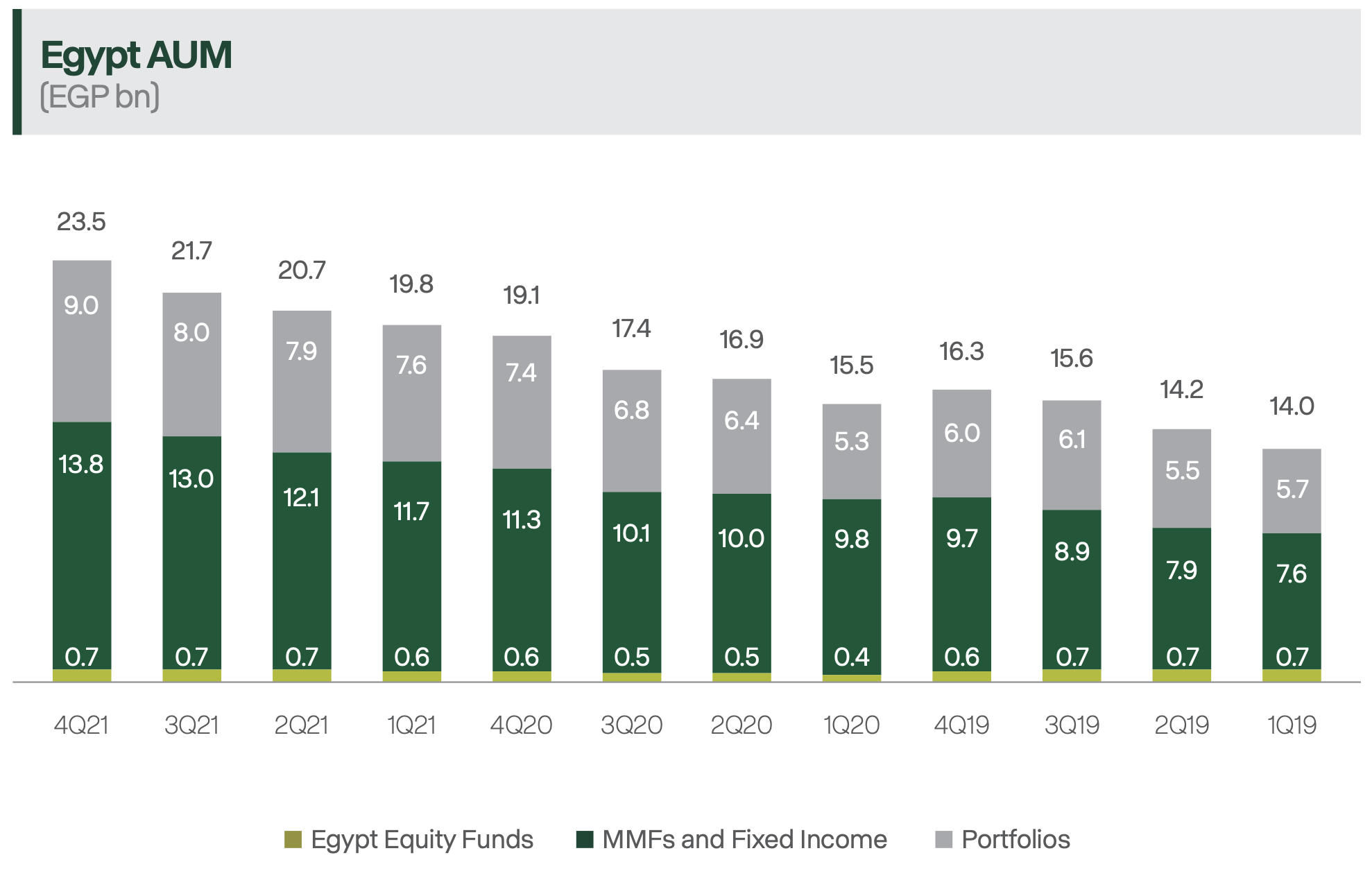

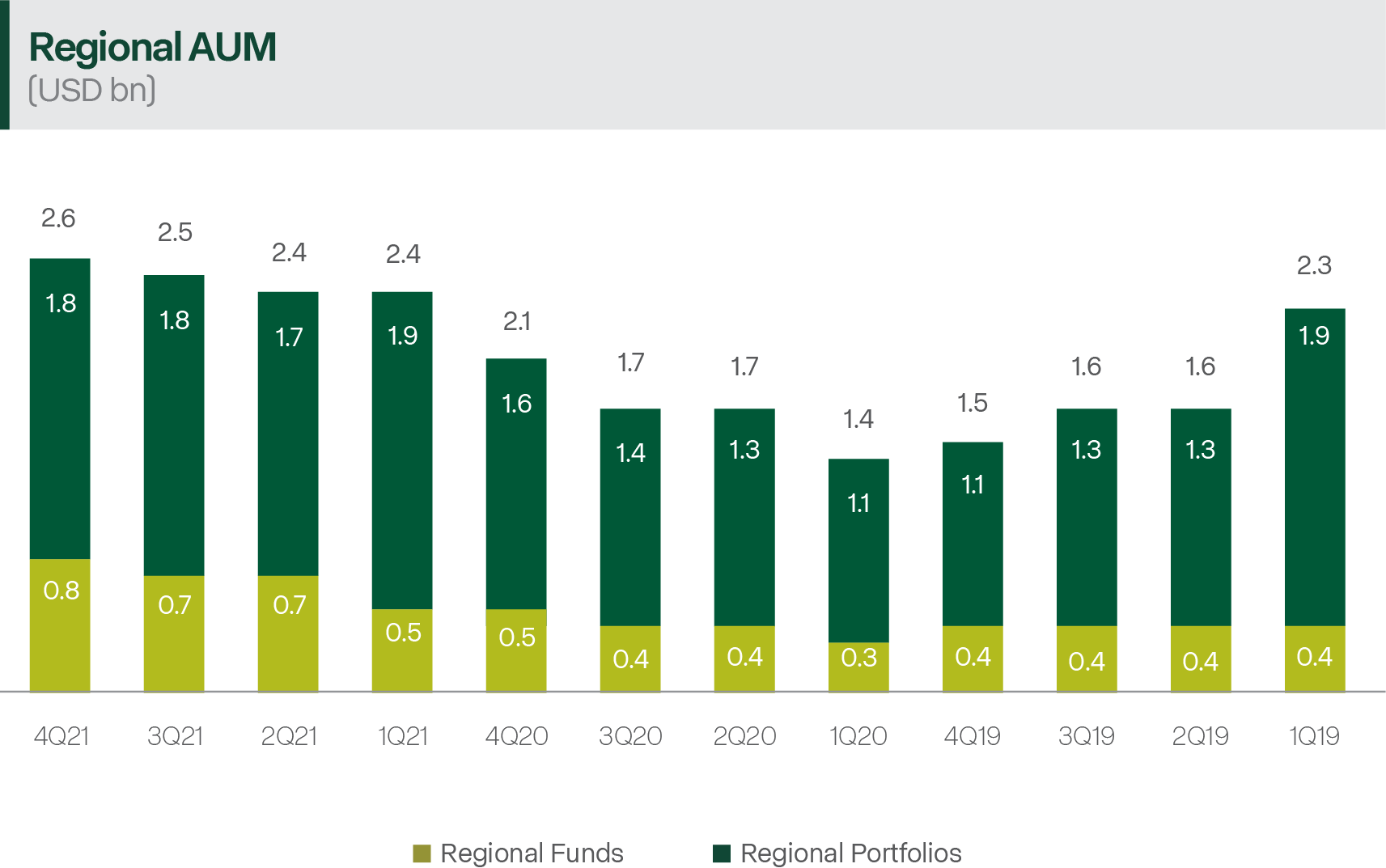

By year-end 2021, the division’s Assets Under Management (AUM) in Egypt saw robust growth, climbing by 23% Y-o-Y to record EGP 23.5 billion on the back of the strong performance from equity markets during the year, in addition to the rising net inflows in Money Market Funds (MMFs). Regional AUMs from the Firm’s regional arm, Frontier Investment Management (FIM) Partners also grew 25% in FY2021 to book USD 2.6 billion, as the division continued to deliver a stellar performance across all its funds and managed accounts, in addition to the higher net inflows from equity portfolios.

The major operational milestones for the division included raising funds of USD 200 million for the Firm’s regional Frontier Investment Corporation Special Purpose Acquisition Vehicle (SPAC). The SPAC was launched with an eye to acquire companies operating in the technology, digital media, e-commerce, financial technology, and digital services sectors across markets with high growth prospects in the MENA region, Sub-Saharan Africa, and South and Southeast Asia. Additionally, the division launched new investment products targeted at the emerging market asset class, with an eye to capture the high-demand present in the asset management space, and better serve the unique and evolving needs of its clients, ultimately cementing its leading position across its regional footprint.

Key Financial Highlights of 2021

Asset Management revenues rose by 45% Y-o-Y in FY21 to EGP 528 million compared to the EGP 363 million reported in FY20, largely due to strong incentive fees booked by the regional asset management arm, FIM, in the final quarter of the year.

Awards

In 2021, EFG Hermes Asset Management was named Best Asset Manager in Egypt and Pan-Africa by the EMEA Finance African Banking Awards for the third consecutive year, as well as the Best Asset Manager in the UAE by the EMEA Finance Middle East Banking Awards. The division was also ranked 17th in the 30 Biggest Asset Managers for 2021 by Forbes Middle East.

2022 Outlook

In 2022, the Asset Management division remains confident in its ability to continue raising the bar across its regional footprint and expects to continue to grow and deliver long-term value to its investors and other stakeholders. The division will push on with its product expansion strategy, introducing a multitude of innovative products and solutions to its existing offerings that will further solidify its position as the region’s leading asset management house.