Management Discussion and Analysis

EFG Hermes Holding delivered a stellar performance during 2021, showcasing an increase in revenues with strong performance across most operations, in addition to the consolidation of aiBANK’s revenues.

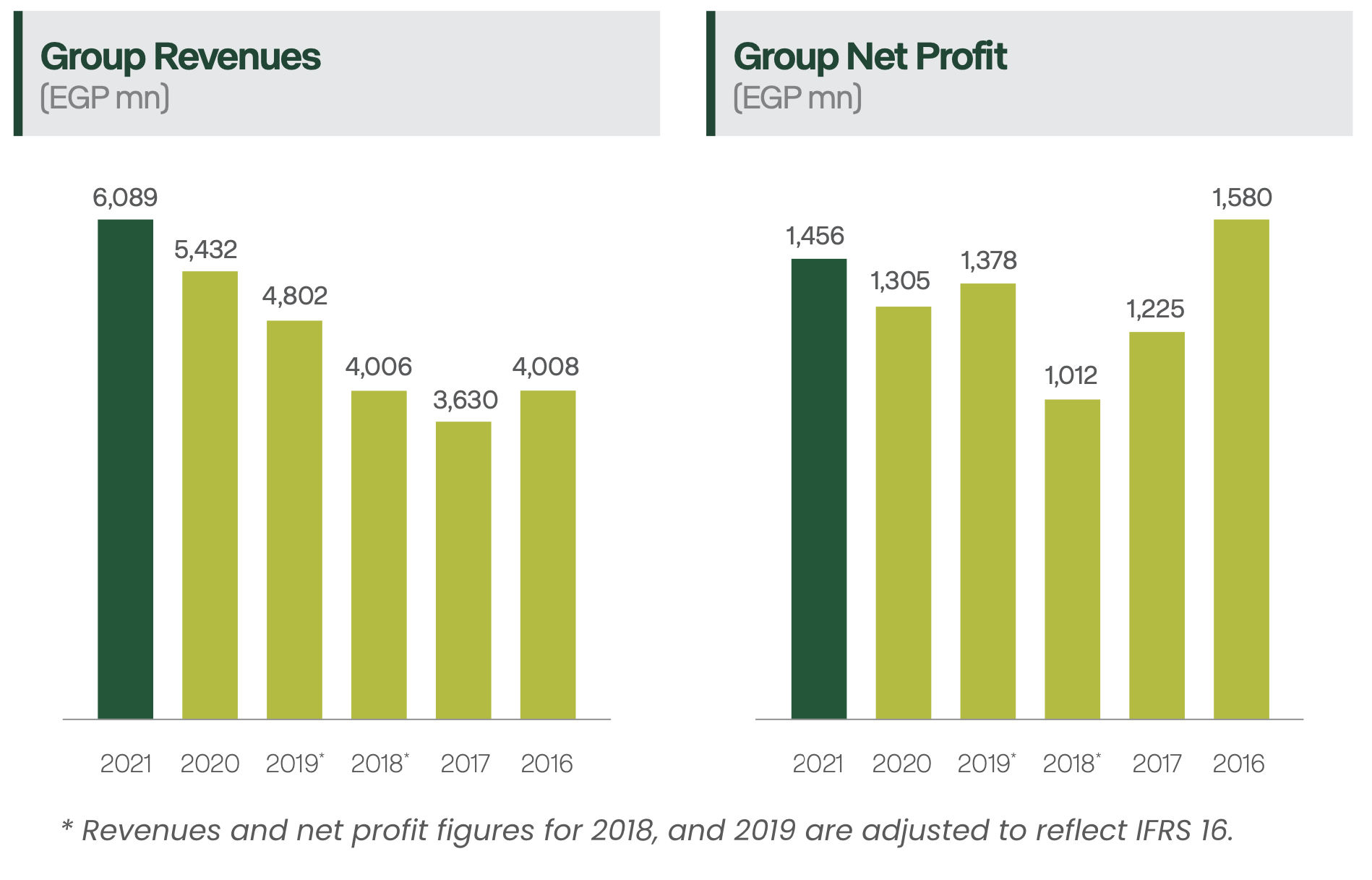

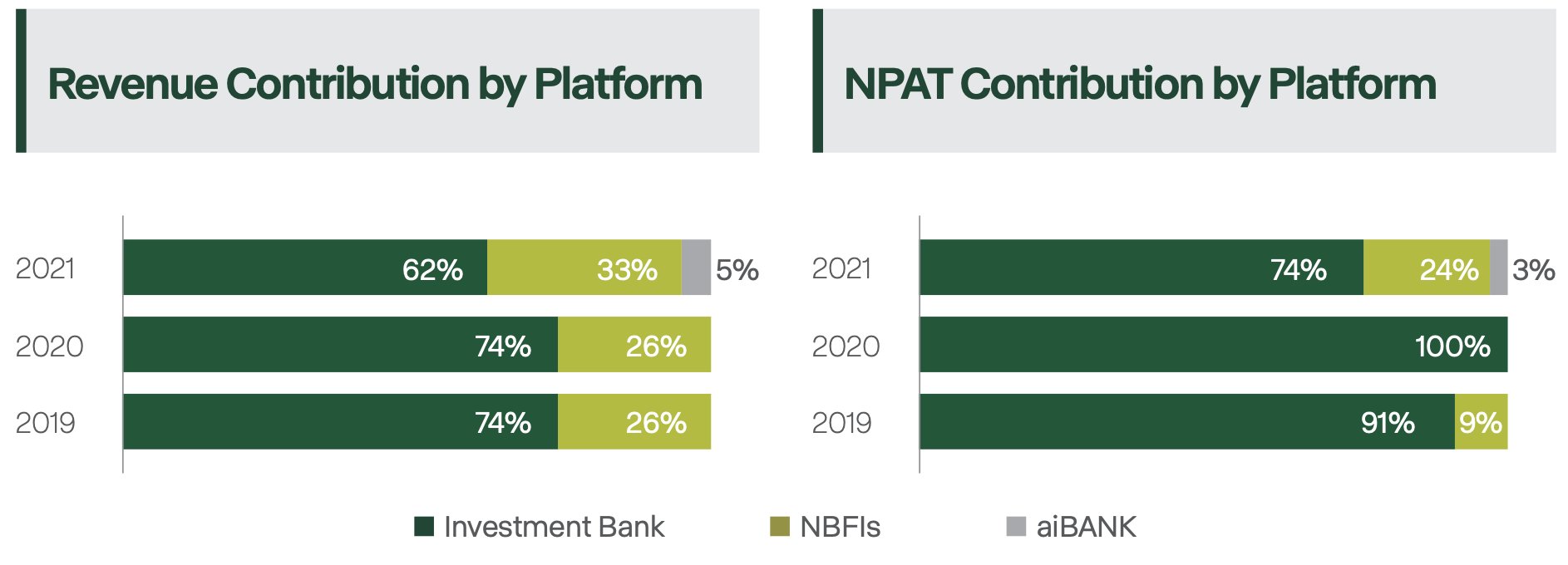

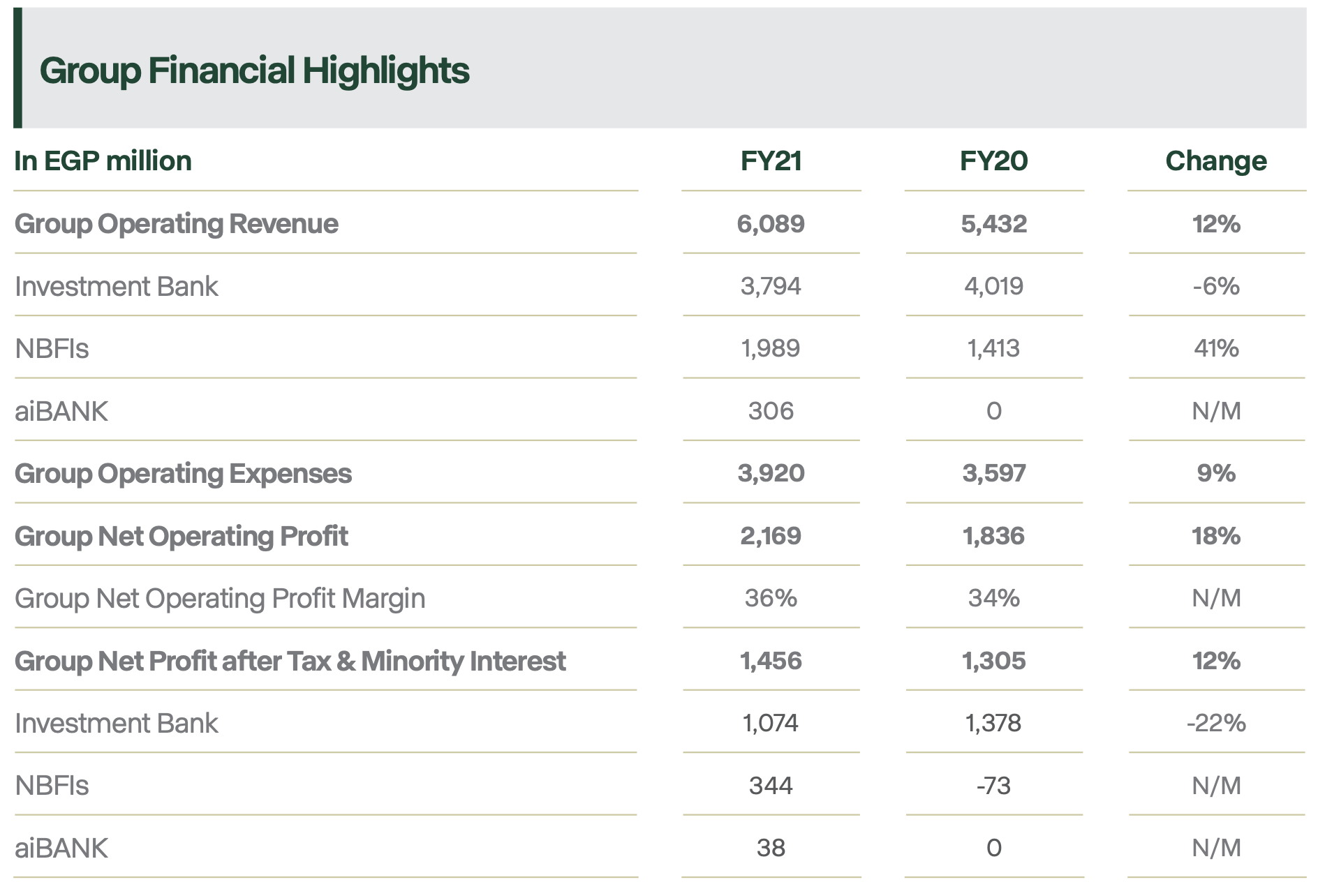

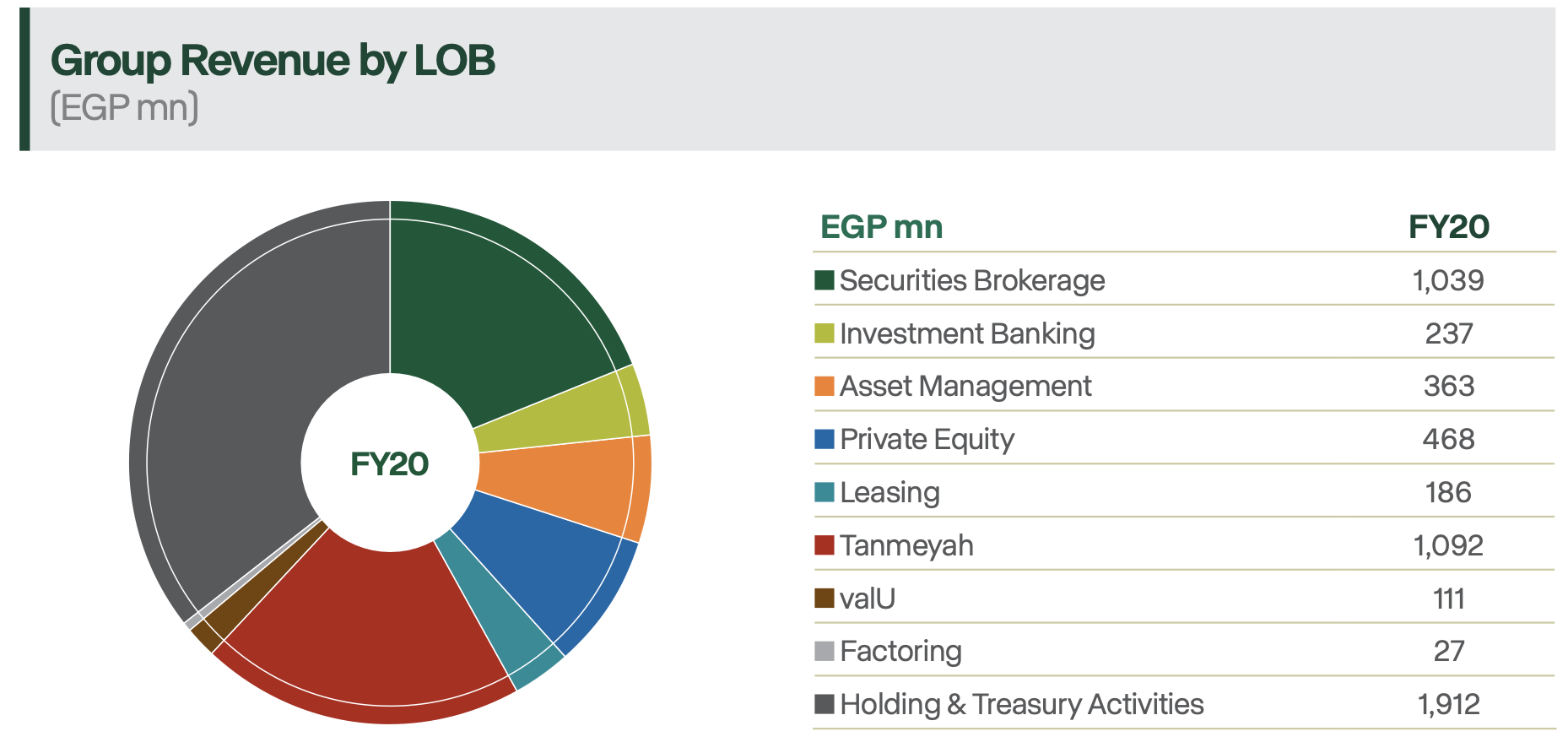

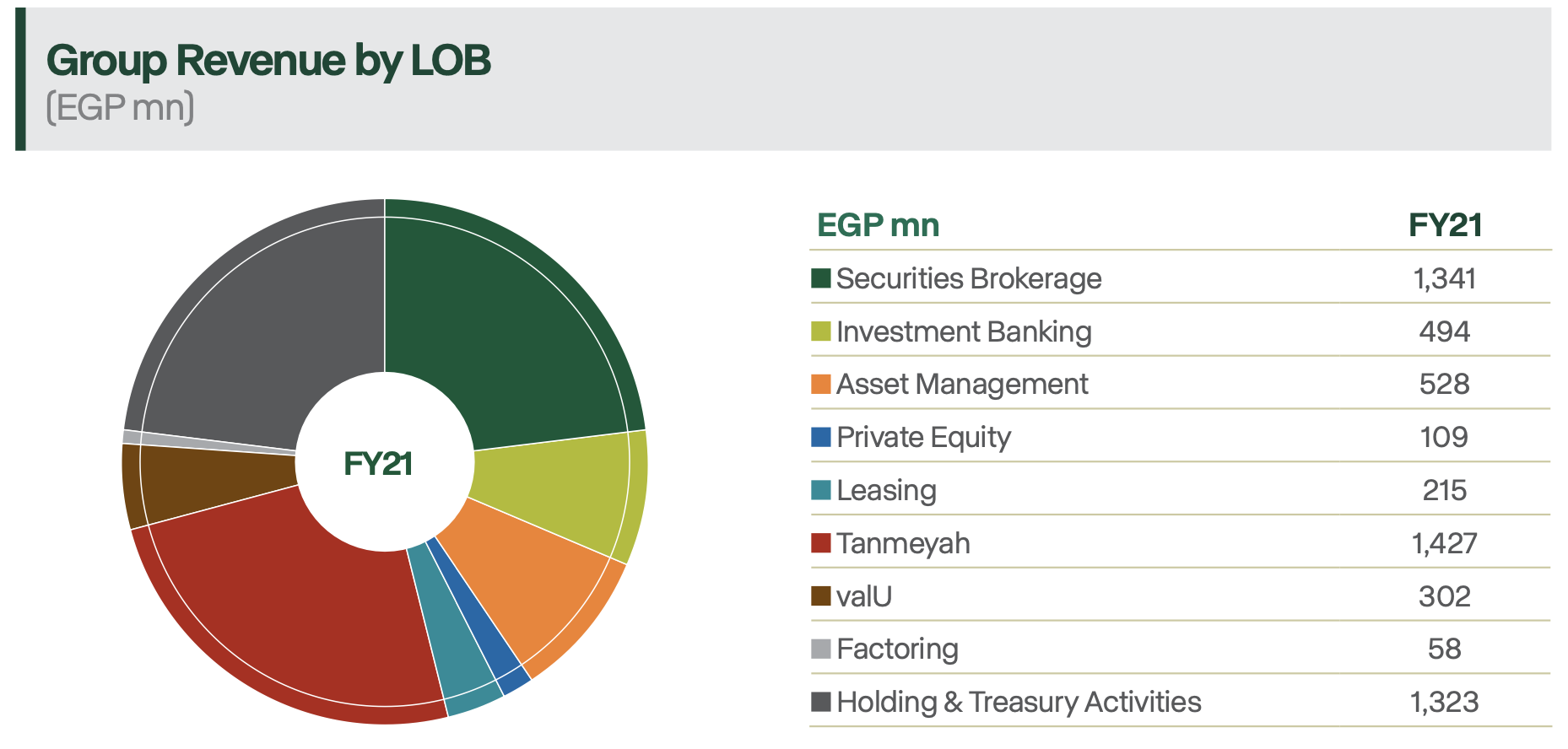

EFG Hermes Holding recorded an increase of 12% Y-o-Y in operating revenues to EGP 6.1 billion in FY21, driven by the exceptional growth across its Investment Banking, Brokerage, and Asset Management divisions, and the NBFI platform. 2021’s performance is a testament to the Firm’s ability to grow revenues, despite the strong realized/unrealized gains on investments and the Private Equity division’s exceptional incentive fees of EGP342 million booked in the comparable year. The NBFI platform, which stood at 33% of total Group turnover, reported revenues worth around EGP 2 billion, climbing 41% Y-o-Y, with outstanding portfolios up a significant 39% Y-o-Y to EGP 13 billion. Tanmeyah, which accounts for 72% of the platform’s revenues, reported a top line of EGP 1.4 billion during the year, up 31% Y-o-Y on the back of strong sales and geographical expansion across Egypt. valU also delivered a remarkable performance this year, with revenues surging 171% Y-o-Y to EGP 302 million due to numerous partnerships signed with leading merchants in vital sectors as well as innovative products launched. The platform’s factoring business, which falls under EFG Hermes Corp-Solutions, also gained significant ground this year, with revenues surging 117% Y-o-Y to EGP 58 million as the business further capitalized on synergies with the Investment Bank. The leasing business, which also falls under EFG Hermes Corp-Solutions, reported revenues of EGP 215 million, up 16% Y-o-Y.

EFG Hermes’ Investment Bank vertical recorded EGP 3.8 billion in revenue on the back of strong performance from the Group’s Sell-Side operations. On the buy-side front, despite a decline in revenues from the Private Equity division, Asset Management performed well, growing its revenues by 45% in FY21. Sell-side operations had a very good year with revenues jumping 44% and the Brokerage arm boasting a lead in Egypt, Dubai, and Kenya in terms of market share. The Investment Banking division successfully concluded 41 ECM, M&A and DCM transactions worth an aggregate of USD 7.9 billion — the highest number of transactions the division has recorded in a single year.

Group operating expenses grew 9% Y-o-Y to EGP 3.9 billion after the consolidation of aiBANK, whose operating expenses came in at EGP 156 million and accounted for 50% of the total increase. Additionally, employee expenses climbed 20% Y-o-Y to EGP 2.8 billion on the back of a scale-up in the NBFI businesses and variable expenses related to the increase in revenues from core operations. Meanwhile, other G&A expenses were largely flat, mainly due to lower operating expenses at the Investment Bank and particularly lower ECL and provisions at the NBFI platform.

EFG Hermes Holding’s net profit after tax and minority interest came in at EGP 1.5 billion, up 12% Y-o-Y largely driven by the continued upward trajectory of the NBFI platform as well as aiBANK, which contributed EGP 38 million to the bottom line.

The Investment Bank

Securities Brokerage

EFG Hermes Securities Brokerage completed USD 71 billion in executions, up 28% Y-o-Y on the back of higher executions in Abu Dhabi, Qatar, Dubai, and Kuwait. The Group was able to maintain its leading position as the broker of choice across multiple markets, retaining its position as the leading brokerage house in Egypt with a market share of 33.8% in FY21. The Group successfully retained 42% of the 13% of foreign participation in the market during the year and 22% of the retail business in Egypt. In parallel, EFG Hermes ranked first on the DFM and second on the ADX, hitting market shares of 35.8% and 13.7%, respectively in FY21. In Saudi Arabia, the Group delivered a seventh-place finish among pure brokers (non-commercial banks) at a 2.0% market share in FY21. Moreover, the Firm held a solid second place in the Kuwait Exchange, closing out the year with a market share of 29.6% in FY21. In Oman, the Group came in fourth, with a market share of 16.6% in FY21. EFG Hermes improved its ranking in Jordan coming in at 11 from 13 last year with a market share of 6.1% in FY21, in addition to a 3.6% market share in Pakistan. The Group successfully ranked first in Kenya for the second consecutive year, recording a market share of 60.8% in FY21 up from 51.6% in the previous year, and ranked fourth in Nigeria with a market share of 5.7% in FY21.

Securities Brokerage recorded revenues of EGP 1.3 billion, representing a significant increase of 29% Y-o-Y in FY21 on the back of higher revenues booked across multiple markets.

Egyptian equities continued to represent the highest contribution to the Brokerage commission pool, representing 27.2% of the total, followed by Kuwait and UAE markets (including Dubai and Abu Dhabi) both coming in second place with c.17.2% and Frontier Markets, including Nigeria, Kenya, Pakistan and other Frontier executions, which came in fourth with a 11.8% contribution in FY21.

Research

EFG Hermes’ Research team had a successful year covering 319 stocks spread across 26 markets by the end of 2021. Additionally, the team added a new market by initiating coverage on E-commerce play and the largest bank in Kazakhstan, expanded small and mid-cap coverage in GCC, continued to build out its utilities coverage, and initiated coverage on two supermarket chains in Sri Lanka and Morocco. Moreover, in the 2021 Institutional Investor poll for MENA and Frontier, the team ranked 1st in Frontier and 2nd in MENA, and was awarded the highest ranked international research provider for Pakistan in Asia Money’s prestigious poll. MIFID and CSA payments came higher Y-o-Y in FY21; with this being mirrored in research revenues. Going forward, the division will continue to ramp up its coverage, with more focus on growth sectors, small and mid-cap coverage, thematic research, and building out its frontier coverage in Vietnam.

Investment Banking

Throughout the year, EFG Hermes’ Investment Banking division successfully concluded a total of 41 ECM, M&A, and DCM transactions worth an aggregate value of USD 7.9 billion, marking the department’s highest number of transactions in a single year.

Backed by 43 of some of the region’s highest caliber investment banking professionals, the division concluded advisory on a multitude of cross-border transactions throughout the year.

Solidifying its position as the leading MENA ECM advisor, the Investment Banking division successfully advised on several milestone offerings across the regional ECM space. The team successfully concluded advisory on Fertiglobe’s USD 795 million initial public offering (IPO) on the Abu Dhabi Exchange (ADX), marking one of the largest listings on the exchange and the first listing of a free zone company onshore in the UAE. The division also acted as joint bookrunner and underwriter on the USD 1.2 billion IPO of Saudi-based ACWA Power on the Tadawul Exchange, which marks EFG Hermes’ third IPO on the exchange in 2021. Continuing its journey with Theeb Rent a Car and its shareholders following the company’s successful IPO earlier in the year, the department acted as joint bookrunner and broker on the sale of a 21% stake in the car rental company through a USD 127.6 million accelerated equity offering. Additionally, the team successfully concluded the advisory on the USD 143 million follow-on sale of Abu Qir Fertilizers and Chemical Industries Company’s shares on the Egyptian Exchange (EGX), underlining EFG Hermes’ commitment to spur private investment in key state-owned assets as part of Egypt’s economic reform agenda.

In the M&A space, the team successfully concluded the advisory to UAE-based Agthia Group on its strategic acquisition of a 100% stake in UAE health snacks company BMB Group for a total value of USD 172 million. The transaction marks the third M&A deal completed for the group in 2021 alone, cementing EFG Hermes’ leading role in the MENA M&A space. Building on its longstanding relationship with Sixth of October for Development and Investment Company (SODIC), the team successfully advised the leading real estate developer on the sale of 85.5% of its EGX-listed shares through a mandatory tender offer (MTO) to a consortium comprising UAE real estate Development Company Aldar Properties and Abu Dhabi Developmental Holding Company (ADQ). The landmark transaction worth USD 388 million marks the largest foreign direct investment in the Egyptian real estate sector to date. The team also advised EFG Hermes Holding S.A.E on the acquisition of a 51% stake in Arab Investment Bank (aiBANK), transforming the group into a universal banking platform in Egypt offering a full spectrum of financial services. Lastly, the department successfully advised TPG’s Evercare Group on the sale of its 50% stake in Islamabad Diagnostic Centre (IDC) to Integrated Diagnostics Holding (IDH) in a deal worth USD 72.4 million.

On the debt front, EFG Hermes continued to grow its debt capital markets (DCM) franchise on the back of the successful execution of several milestone transactions comprising diversified financing options. The team successfully concluded a series of securitization issuances, unlocking new opportunities for a multitude of clients. The department concluded the advisory to EFG Hermes Holding’s wholly-owned subsidiary, EFG Hermes Corp-Solutions, on the first issuance of its EGP 3 billion securitization program, through a bond offering worth USD 50.3 million. Additionally, the division successfully advised Misr Italia Properties, one of Egypt’s leading real estate developers, on its first securitization issuance, worth USD 50.6 million, as part of an EGP 2.5 billion securitization program. The department also concluded the USD 40 million securitization issuance for Pioneers Development Company. Continuing to expand its service offerings in the ever-growing DCM space, the division also advised on the USD 12 million debt arrangement for Mac Beverages Limited as well as the issuance of a senior unsecured short-term note for the Hermes Securities Brokerage Company (HSB) worth USD 35 million. Lastly, the team acted as financial advisor on the lease financing for real estate development firm Madinet Nasr for Housing and Development (MNHD) worth USD 44.6 million.

The Group’s Investment Banking Division recorded revenues of EGP 494 million, up 108% Y-o-Y in FY21.

Asset Management

EFG Hermes Egypt’s AuMs rose 23% Y-o-Y, driven by net inflows and markets’ strong performance in FY21. Net inflows represented 11% of the increase in AuMs, and was driven by strong inflows in the MMFs, followed by inflows in equity and fixed income portfolios. Markets’ appreciations represented the remaining 12% of the increase in total AuMs and is attributed to MMFs positive performance together with equity/FI/balanced portfolios appreciation during the year; however, equity portfolios’ strong performance was the key driver.

In parallel, EFG Hermes’ regional asset management arm Frontier Investment Management “FIM” saw its AuMs rising 25% over the year, triggered by its strong performance and markets appreciation in part, and net inflows, which reflects largely a SPAC for USD 200 million.

The Group’s Asset Management Division revenues rose 45% Y-o-Y to EGP 528 million.

Private Equity

Vortex Energy IV, a global renewable energy platform managed by the private equity arm of EFG Hermes, injected its first tranche in relation to its investment in Ignis Energy Holdings, parent company of Spanish independent integrated renewable player Ignis Group. Vortex Energy will inject over EUR 625 million through its newly launched Vortex Energy IV Fund and its co-investors into Ignis via a series of capital injections, which will be deployed over the coming few years subject to certain conditions. This will allow Ignis to fund its growth plans and transform into a fully integrated renewable independent power producer (IPP) in Spain and other geographies. This capital contribution from Vortex Energy IV and its co-investors will allow Ignis to own and operate a growing share of the projects that it develops.

The division’s education platform, (Egypt Education Platform – EEP) continued expanding its operations during the year after entering into definitive agreements to acquire a recently built state-of-the-art mega campus located in Sheikh Zayed city, West of Cairo. The new campus will host EEP’s recently acquired Hayah brand under the name “Hayah West” and will mark Hayah’s first expansion into the west side of Cairo. The new campus will be able to house more than 1.7k students. EEP also executed its first management agreement with the Sovereign Fund of Egypt (TSFE) and Mobica to manage and operate 2 new premium national schools that will be developed in 6th of October City with a combined capacity of c.5k students. The new schools are expected to start operations in September 2023. With these new developments, the EEP is set to enter 2022 with a diversified portfolio comprising of 10 schools spread out across Cairo and Alexandria under various stages of development and with a combined capacity approaching c.20k students. The Private Equity division continues to explore potential growth opportunities in the market through future acquisitions or development of new schools, with plans to close at least 2 new investments in 2022.

On the healthcare front, United Pharma (“UP”) has successfully closed financial year 2021 realizing outstanding revenue growth, exceeding its Egyptian market peers. During FY21 UP continued to ramp up its sales, almost doubling its yearly output on an annual basis. The Company has diversified its distribution network, with its largest client segment contributing only c. 30% of total sales; UP successfully increased its market share and market ranking as per IMS estimates and is now a market leader in the Hospital Solutions space. During FY21 UP has almost doubled its sales Y-o-Y, with a realized EBITDA margin, exceeding several established market peers. UP’s full facility upgrade plan is in its final stages and on track to be finalized in the early months of 2022, setting up the necessary capabilities to drive the company’s upcoming growth plans.

In parallel to the ongoing value creation process within UP, Rx Healthcare platform has progressed with a number of promising acquisition opportunities in the B2B and B2C pharma segments, currently at advanced stages of negotiation and execution, and with potential aggregate deal values exceeding EGP 1 billion, supporting EFG Hermes’ healthcare platform strategy of expanding its investments in the pharmaceuticals sector.

Private Equity revenues were adversely affected by the comparable year’s high non-recurring revenue of USD 342 million from Vortex III exit; yet, 4Q21 revenues gained 140% Y-o-Y to EGP 33 million, driven partially by higher management fees as AUM grew Y-o-Y.

Non-Bank Financial Institutions

Tanmeyah

Tanmeyah, the Firm’s microfinance arm, witnessed an increase of 24% Y-o-Y in total loans issued to reach EGP 5.2 billion in FY21. This was reflected on the number of active borrowers and processed applications, which grew 14% Y-o-Y and 18% Y-o-Y, respectively. Consequently, Tanmeyah’s outstanding portfolio climbed 22% Y-o-Y to stand at EGP 3.7 billion at the end of the year.

In efforts to further grow its portfolio, Tanmeyah changed its MEL product structure to start from EGP 7k instead of EGP 5k and up to EGP 50k, which contributed to the increase in the average ticket size, reaching EGP 14.5k in FY21. Sales from the Women In Business (WIB) product ramped up by 619% Y-o-Y in FY21, as the company rolled out the product across all its branches, and further enhanced the product’s pricing.

Alongside its product development efforts, Tanmeyah continues to expand its geographical presence. By the end of 2021, the company had marked the milestone of hitting the 300 branch mark. The 16 new branches that started operating in 2021 contributed 5% to the increase in sales, and 6% to the value of the company’s outstanding portfolio.

In 2021, Tanmeyah’s revenues grew by 31% Y-o-Y to record EGP 1.4 billion, up from EGP 1.1 billion recorded at year-end 2020.

valU

valU is a leading buy-now pay-later (BNPL) lifestyle-enabling fintech platform offering consumers payment-on-installment-programs. The Group’s BNPL platform delivered an exceptional performance, with the total number of transactions and Gross Merchandise Value (GMV) growing twofold in FY21; growing 131% Y-o-Y and 138% Y-o-Y to 452 thousand and EGP 2.4 billion, respectively. valU’s network grew to 1,657 merchants in FY21, as the platform continued expanding its market reach and offering a wider variety of goods and services to satisfy customers’ different lifestyle needs.

The most notable additions of the year were valU’s partnerships with digital marketplaces Jumia and Noon, two of the three biggest e-commerce businesses in Egypt. valU’s customer-base grew significantly, hiking by 134% Q-o-Q, and 108% Y-o-Y. By year-end 2021, valU’s total number of customers had reached 190,000. This pool of customers comes as a strong testament to valU’s success in increasing its penetration and its leading market share and position in the BNPL market in Egypt.

Shedding light on the app business, the outstanding portfolio increased 148% Y-o-Y, reaching EGP 1.96 billion at the end of FY21. In terms of the non-app business, the B2B outstanding portfolio declined by 8% Q-o-Q and 23% Y-o-Y, as valU shifts its focus to the growth of its B2C operations.

valU’s revenues grew by a remarkable 171% Y-o-Y to record EGP 302 million, as sales and margins continued to improve. valU’s ranking in the Egyptian market also jumped to second place during the year, with a market share of 23.8%.

EFG Hermes Corp-Solutions

Leasing

EFG Hermes Corp-Solutions’ leasing business recorded a total value of bookings amounting to EGP 3.9 billion in FY21, up 63% Y-o-Y, primarily driven by the significant ramp up in activity during the year. These new bookings were spread across 86 contracts in FY21 compared to 78 contacts in FY20.

The leasing business’s outstanding portfolio registered a stable value of EGP4.7 billion at the end of FY21, as the division securitized EGP780 million of the portfolio, in addition to the terminations carried out by a number of the business’s clients.

EFG Hermes Corp-Solutions’ leasing team continues to capitalize on cross-selling capabilities, with an eye to offering bundled financial solutions to its clients. At present, Corp Solutions has 7 Joint clients utilizing Leasing and Factoring facilities.

In 2021, leasing revenues increased by 16% Y-o-Y to register EGP 215 million, on the back of the securitization gains during the year. EFG Hermes Corp-Solutions’ leasing business was ranked 3rd in FY21, with a market share of 10.4%.

Factoring

2021 was an exceptional year for EFG Hermes Corp-Solutions’ factoring business, with the business recording total bookings of EGP4.2 billion, up from EGP1.6 billion in 2020. The factoring business’s portfolio doubled Y-o-Y to reach EGP1.9 billion by the end of FY21, with the number of approved clients increasing by 73% Y-o-Y from 44 clients at the end of FY20 to 76 clients at the end of FY21.

Factoring revenues reported EGP 58 million, up 117% Y-o-Y, driven by strong bookings and drawdowns. During the year, the factoring business topped the FRA ranking in FY21, coming in at first place with a market share of 22.8%.

aiBANK

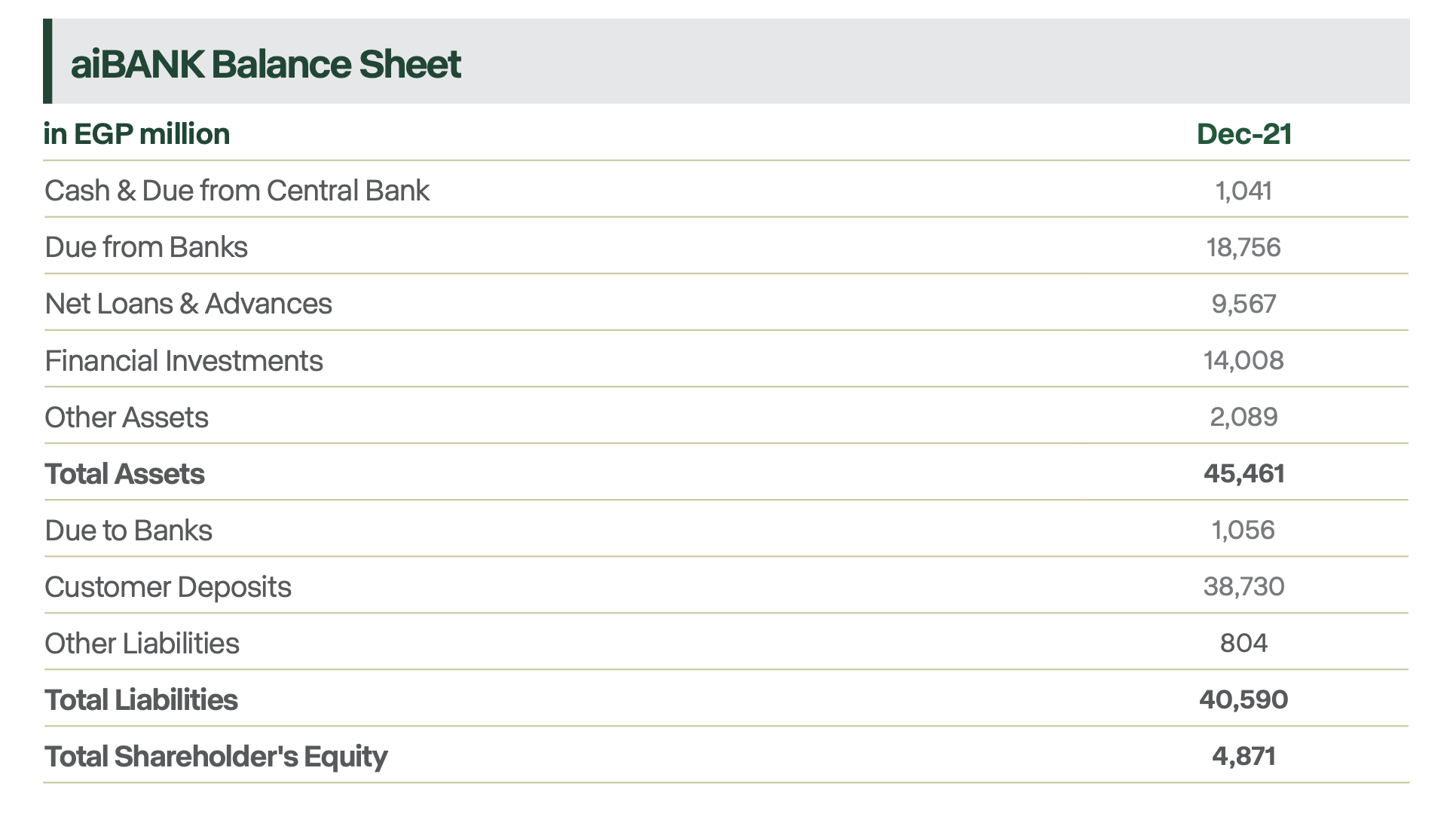

The acquisition of a 51% majority stake of aiBANK was completed in 4Q21, and thus the Group’s P&L reflect the Bank’s November and December P&L figures.

Below tables show aiBANK’s 2-month performance and the standalone balance sheet as at the end of December 2021.

As primary shareholder, EFG Hermes Holding will support aiBANK to improve its financial indicators, competitiveness in the market, and compliance with the CBE’s regulations, leveraging the Firm’s experience and that of The Sovereign Fund of Egypt (TSFE). The Firm will also refocus the bank’s strategy towards financing small and medium-sized companies, upgrading the product portfolio, and utilizing fintech to optimally reach and serve a wider segment of society.

Entering the banking sector is in line with EFG Hermes Holding’s strategy to diversify its products and services offering, solidifying the Firm’s position as the leading financial institution in Egypt offering integrated financial services, by becoming a universal bank. This model benefits all our business sectors as they become more capable of providing almost any financial service to individual, retail, and corporate clients through one single platform. This business model also supports the Egyptian government's efforts to drive economic growth and succeed in its digital transformation and financial inclusion agenda.