Securities Brokerage

Overview

EFG Hermes Securities Brokerage, the MEA region’s premier brokerage house, offers its client base a comprehensive offering of innovative products and services, in addition to an unrivaled coverage across more than 75 MENA and Frontier Emerging Markets (FEMs). The division continues on its upward trajectory, with its operational footprint spanning across four continents in Egypt, Kuwait, the UAE, Saudi Arabia, Oman, Jordan, Pakistan, Kenya, Nigeria, and Bangladesh, with regional offices in the US and the UK. Throughout its years of operations, the Brokerage division’s client base has rapidly grown to house regionally and globally renowned institutional and individual investors. Backed by EFG Hermes’ unrivaled in-house research capacities, EFG Hermes Securities Brokerage continues to provide its clientele with secure multi-platform trading tools, market intelligence and insights, and unparalleled executional capabilities, ensuring maximum generated returns that best serve different investor preferences and risk profiles.

Operational Highlights of 2021

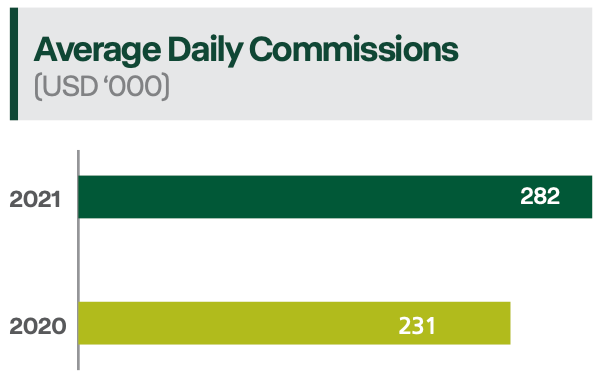

After a long year of market instability in 2020, capital markets performed solidly in 2021 and continued on the upswing as the year closed out. Volumes expanded significantly in 2021 throughout the division’s markets due to a pickup in retail trading activity. While this resulted in an increasingly competitive environment for brokerages across the region, EFG Hermes Securities Brokerage successfully captured the upside of market recovery, leveraging its decades-long, on-the-ground experience across its regional footprint.

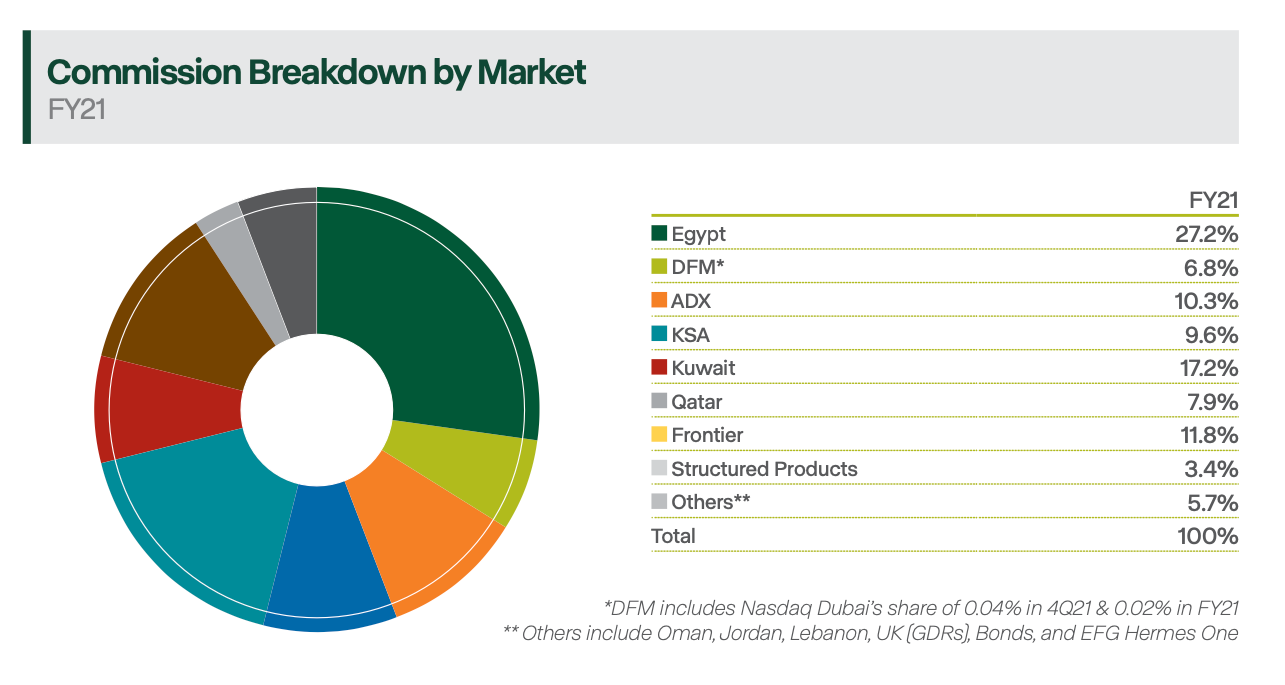

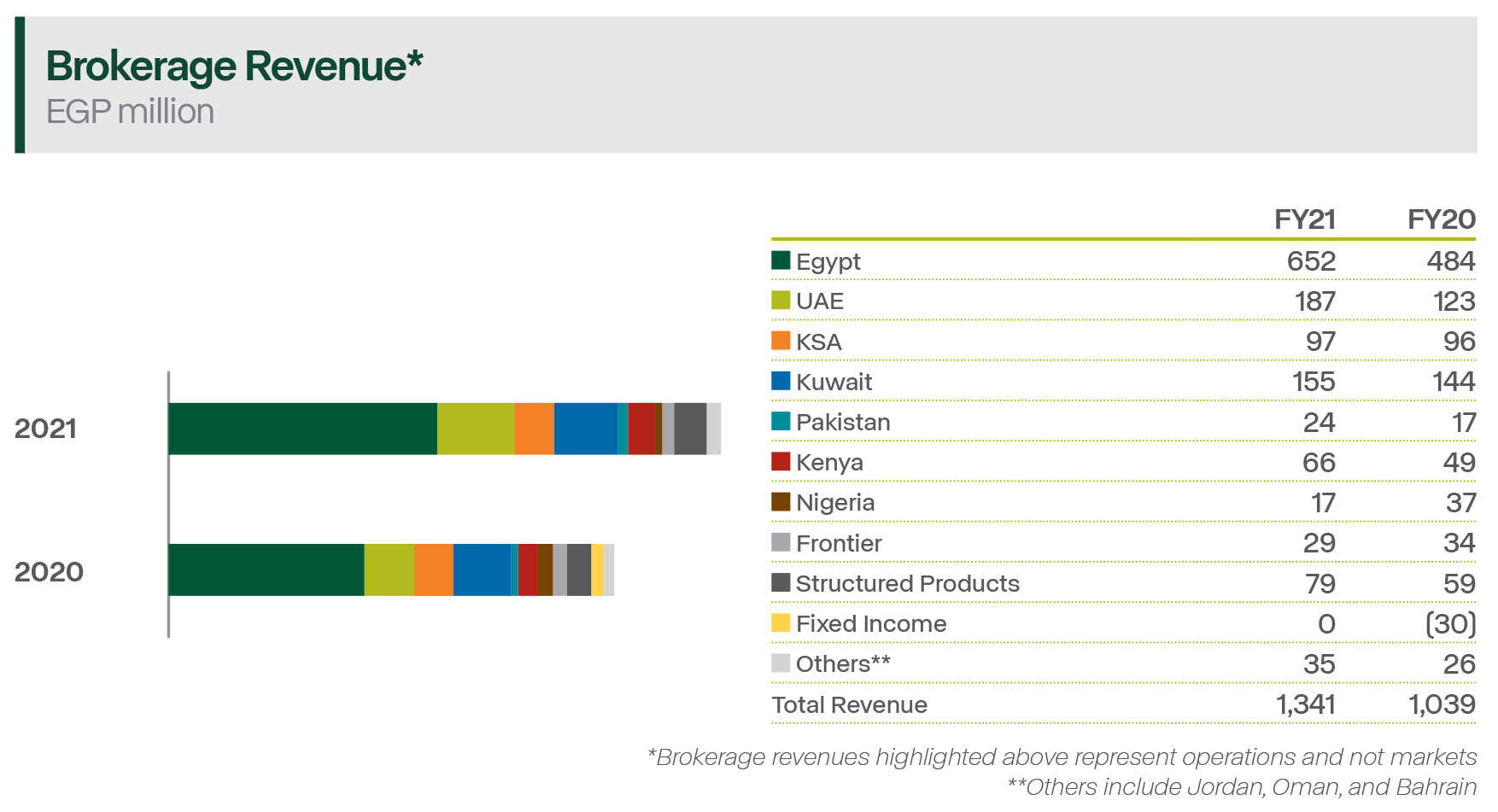

In 2021, the company registered a significant 29% Y-o-Y rise in Brokerage revenues to EGP 1.3 billion, primarily driven by the increase in retail activity in markets such as Egypt, Kuwait, and Jordan. In terms of pure commissions registered in regional markets, Egypt remained the leading contributor to the company’s Brokerage commissions, at 27.2%. Frontier markets booked an 11.8% contribution, while UAE markets (Dubai, Abu Dhabi, and Nasdaq Dubai) recorded a contribution of 17.1%, in addition to Kuwait’s commissions contribution coming in at 17.2%.

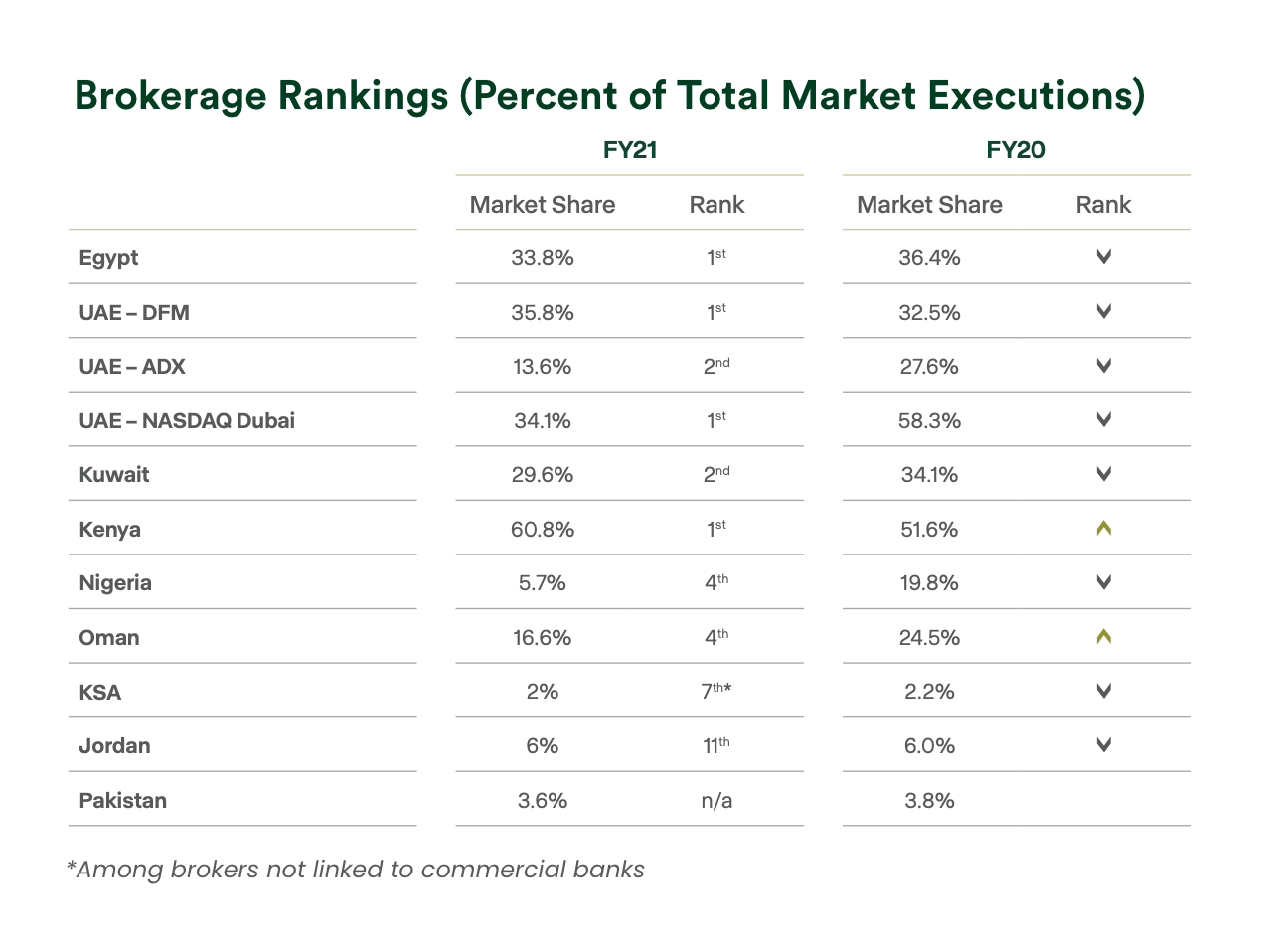

Despite the solid increase in revenues, the rise in volumes spurred competition in the markets where the division operates. EFG Hermes Securities Brokerage’s regional market shares fell flat for the year, with its market share in the Egyptian market hitting 33.8%, down 2.6% from the 36.4% in 2020. However, the division still successfully managed to maintain its first-place ranking on the EGX, having capitalized on its foreign institutional base. Foreign participation came in at 13.3% during the year, with EFG Hermes successfully capturing 41.7% of these institutional inflows.

Kuwait was one of the regions that witnessed a substantial ramp up in total traded volumes, number of deals, and total traded values. The high liquidity position in the market enabled EFG Hermes’ Brokerage division to record the highest number of executions ever traded since inception, with total executions recording an 11% increase to USD 13.9 billion against the USD 12.5 billion booked at year-end 2020. The division ranked second in the Kuwaiti market, doubling its revenues during the year, securing a solid market share of 30% in 2021, and capturing 62.9% of foreign institutional inflows for the year.

In the UAE, EFG Hermes Securities Brokerage successfully managed to grow its market share on the DFM to 36% in 2021 and sustain its leading market position, despite flat trading volumes in the market. On the ADX, EFG Hermes’ market share stood at a solid 13.7%, fortifying its ranking on the exchange in second place. On Nasdaq Dubai, the division’s market share remained flat on the back of stagnant trading volumes. However, despite the challenging circumstances, EFG Hermes Securities Brokerage successfully managed to maintain its lion’s share on the exchange.

In the Kingdom of Saudi Arabia, despite the increase in market volumes of around 7%, EFG Hermes Securities Brokerage’s trading volumes increased by 11%, with the division maintaining its market share of 2%. Jordan proved to be a promising market in 2021. EFG Hermes Securities Brokerage registered a 6% market share, maintaining the share captured in 2020.

The Firm’s Direct Market Access (DMA) trading platform made progress throughout the year, automatically linking foreign institutional investors to the system’s database and granting them access to directly submitting their orders into the market. With this significant development in the digital brokerage space, EFG Hermes continues to introduce innovative financial solutions to its investors and expand its product and service offerings.

Frontier Markets

The Pakistani market witnessed yet another year of hurdles because of macroeconomic and political uncertainties, including a 10% further devaluation of the currency, interest rate hikes, and delays surrounding the resumption of the IMF program. As such, investors were bearish on the market during the year, but due to the Firm’s solid footing in the foreign institutional space in the market, the division’s market share stood at 3.6%.

In Kenya, foreign inflows and local asset manager positioning for the post-pandemic recovery buoyed the market for another year. As such, the division re¬ported a third year of solid performance, with EFG Hermes continuing to hold onto its first-place position with a 60.8% market share.

Meanwhile in Nigeria, volumes continued to taper as the year progressed, with the decline in liquidity attributed to a generally weak macroeconomic environment with the currency at the forefront, and the allocation of flows from equities towards the fixed income market. In saying this, EFG Hermes leveraged the strides made in the previous year, with the Firm standing as the fourth leading broker in the country with a 5.7% market share.

Online Trading Platforms

[text] In 2021, the division launched an updated version of the EFG Hermes One application, by leveraging synergies inherent in its business model at a critical juncture in the Egyptian capital market story, as equity market retail activity picked up and fintech solutions expanded in scope and importance. Today, EFG Hermes One is a one-stop-shop digital brokerage solution and, in turn, continues to maintain its position at the helm of the Egyptian fintech space. The EFG Hermes One application now allows investors to tap into a wealth of investment knowledge, execute informed trades, and monitor their portfolios in real time — all through a simpler, user-friendly interface. It also offers a simplified digital onboarding process, permitting users to create an account faster than ever before. The app now also features a roster of tools and trading options, such as margin trading, short selling and same-day trading, among others. Moreover, EFG Hermes One users can utilize the application’s new ‘Learn’ tab, a knowledge hub where they can access unparalleled investor intelligence from EFG Hermes Research to boost their trading knowledge. Users will also have access to the EFG Hermes One Virtual Simulator, allowing them to simulate the trading experience on the application and build their knowledge and skills prior to executing real trades.

Also, during the year, EFG Hermes extended the EFG Hermes One platform beyond Egyptian borders, launching the all-new EFG Hermes One application in Kenya. The expansion unlocked a myriad of investment opportunities for retail investors, with the online platform offering seamless online stock trading on the Nairobi Securities Exchange (NSE). The launch of the application came on the heels of the NSE’s introduction of day trading for retail investors, allowing them to buy and sell stocks as well as settle trades in a single day. The move formed an integral part of the Firm’s frontier strategy to open up the market to further retail participation, see more equities listed on the NSE and grow the value of equity markets to 50% of Kenya’s GDP.

With demand for seamless and integrated digital solutions gaining significant traction in all industries, the need to provide digital access to the Firm’s brokerage services became apparent. One of the major milestones for the Firm in 2021 was the stellar performance delivered by EFG Hermes’ Bahraini subsidiary, OLT Investments International. The Firm’s online platform in collaboration with Saxo Bank has managed to significantly grow its global client base, with assets under management growing twofold by year-end 2021, placing EFG Hermes amongst the region’s most prominent players for online trading. Since its inception, the digital platform has quickly gained traction, and the Firm was successfully able to rapidly increase its client acquisitions.

Structured Products

The Structured Product Desk was launched in 2016 as an integral part of the Firm’s strategy to grow its capital market business and deliver a suite of diverse products to the franchise. 2021 saw EFG Hermes Securities Brokerage’s Structured Product Desk’s revenues grow by 33% to record EGP 79 million versus the EGP 59 million booked at year-end 2020.

Unique Corporate Access

In efforts to honor its commitment of unlocking lucrative investment prospects for global and regional investors across key sectors in the world’s most promising markets, and in light of the unprecedented conditions imposed by the onset of COVID-19, EFG Hermes continued to hold its investor conferences in a virtual format throughout 2021.

In March, EFG Hermes’ Third Virtual Investor Conference facilitated over 12,000 meetings, bringing together over 197 companies with more than 700 Investors from 253 global institutions, with a combined market cap of USD 898 million. The Fourth Virtual Investor Conference held in September saw an even more diverse turnout, with the conference facilitating 14,800 meetings with 215 companies representing 35 countries, as well as over 720 investors from over 260 institutions, with a combined market cap of USD 3.02 billion.

Key Financial Highlights 2021

EFG Hermes Securities Brokerage’s revenues climbed by 29% y-o-y to EGP 1.3 billion in 2021, on higher revenues generated by favorable market conditions resulting in higher volumes across multiple of the Firm’s markets of operation.

Awards

In 2021, the team’s success garnered recognition from numerous international ranking institutions and awarding bodies, including Best Brokerage Services by Africa Global Funds; Best Broker in Egypt and Kenya by the EMEA Finance African Banking Awards; Best Broker in the Middle East, UAE, KSA, Kuwait, and Oman by the EMEA Finance Middle East Banking Awards; in addition to being ranked first for Best International Brokerages, and third for Best Brokerages for Sales, Best Brokerages for Corporate Access, and Best Brokerages for Execution, in Pakistan in the Asiamoney International Brokers Poll.

Outlook

Going forward, the division aims to capitalize on the rapid recovery witnessed across regional markets, and the myriad of achievements made during 2021. In its local market, EFG Hermes Securities Brokerage will continue to leverage its substantial portfolio of institutional investors, with an eye to further increase its market share. In the UAE, the significant pick up in equity markets evident from the rapidly growing number of IPOs unlocks numerous opportunities for investors looking to expand trading prospects. With its leading market position in the DFM and on the ADX, EFG Hermes Securities Brokerage is well positioned to capture an even larger share of the market, as well as higher foreign institutional flows. In Kuwait, the division is working towards obtaining a Qualified Broker License, which will enable it to introduce margin trading into the market and offer investors a multitude of compelling opportunities with lucrative prospects. Jordan’s market conditions remain promising, and the Brokerage division aims to continue expanding its product and service offerings in the market, capturing a larger market share. To further build on its solid achievements made in Sub-Saharan Africa, the division continues to work towards developing and growing an East and West financial hub through its Kenya and Nigeria bases. Simultaneously, it will also work to grow its presence in Southeast Asia, building on the remarkable achievements made in Pakistan and Vietnam. Alongside the division’s regional expansions and developments, EFG Hermes Securities Brokerage is undergoing processes to refurbish its online platforms, strengthen its technological infrastructure, and expand its online presence to become perfectly positioned to capture larger market shares and increase its client acquisition, in addition to more expected success for the DMA trading platform. All in all, the division will continue to work towards cementing its solid position as a broker of choice throughout its footprint.